Alaska Airlines says it is starting to 'turn a corner' despite tariffs

Published in Business News

Alaska Air Group reported Wednesday much lower profits in the second quarter compared with the same time period last year, but it remained optimistic amid the impact of tariffs and cautious consumer spending.

In the second quarter, which runs April to June, Alaska reported $172 million in profit, or $1.42 per share. In the same period last year, Alaska reported $220 million, or $1.71 per share.

But Alaska, like other airlines, is optimistic that the worst impacts of the trade war are over. Using adjusted figures, Alaska beat its guidance for the second quarter this year, surpassing its expectation for earnings per share.

In the first three months of this year, as the tariffs were first announced, Alaska reported a loss of $1.35 per share.

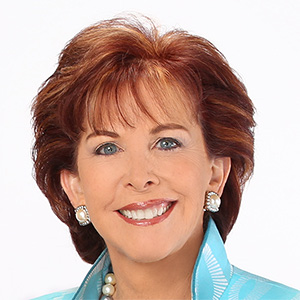

“It seems like we’re starting to turn a corner on that front,” Ryan St. John, Alaska’s vice president of finance, planning and investor relations, said in an interview Wednesday.

Over the past four weeks, Alaska has seen a “pretty strong uptick in bookings” for leisure and business travel, St. John said.

Volatile fuel prices have “calmed down” and Alaska itself has hit big milestones, he continued, including launching its first trans-Pacific route and introducing its third new long-haul route in its quest to expand international service from Seattle.

Alaska’s global expansion is fueled by its $1.9 billion acquisition of Hawaiian Airlines last September, which equipped the carrier with a fleet of widebody planes. Those aircraft — including Boeing’s 787 Dreamliners and European plane manufacturer Airbus’ A330s — allow Alaska to fly across the Pacific Ocean and reach new destinations. Before the acquisition, Alaska primarily operated Boeing’s 737 MAX, a narrowbody plane that offers a shorter range than the massive widebody jets.

Since the acquisition, Alaska has announced three new long-haul routes from Seattle to Tokyo; Seoul, South Korea; and Rome.

The new route to Tokyo, the first to take off in May, has been about 80% full, St. John said. That's a positive sign of customer interest, he continued, since Alaska’s average load factor is 84%.

Other airlines that reported second-quarter financial results before Alaska shared the carrier’s optimism. Delta reinstated its profit outlook for the year, after rescinding its guidance when President Donald Trump first introduced sweeping tariffs that would upend global trade. United, which beat Wall Street expectations, attributed its year-over-year growth to “less geopolitical and macroeconomic uncertainty.”

Alaska ended the quarter “with a result that was even better than we anticipated,” St. John said.

The company generated $376 million in operating cash flow in the second quarter, compared with $580 million in the same period last year.

Revenue in the second quarter increased to $3.7 billion, Alaska reported, with premium cabin revenue growing 5% year over year and cargo revenue growing 34%.

Unit costs increased 6.5%, in line with its guidance, Alaska said in its earnings release.

Alaska’s fleet

Though Alaska is optimistic customer demand won’t be severely hit by tariffs, it did get caught in the trade war earlier this year when it delayed delivery of two planes from Brazilian manufacturer Embraer because it did not want to accept additional costs from the levies.

As a result, Alaska’s regional carrier Horizon Air had to trim its summer flight schedule.

Alaska has since taken delivery of the two planes, St. John said Wednesday, after coming to “a resolution that we felt was good for Alaska.” He did not disclose details on the agreement.

Aside from the Embraer planes, Alaska doesn’t typically buy planes from highly tariffed countries. Most of its fleet consists of Boeing planes and Hawaiian Airlines' existing Airbus aircraft.

In the second quarter, Alaska also took delivery of three 737-8s, four 737-9s and two A330-300 freighters.

Those two Airbus freighters complete an agreement struck between Hawaiian Airlines and Amazon two years ago to transport cargo for the e-commerce giant. Amazon pays Hawaiian, and now Alaska, to operate up to 10 freighters, while Amazon sets the schedules and determines what goes on the planes.

St. John said the deal is one prong of Alaska’s goal to diversify its cargo business, and that the company sees more opportunity to monetize the extra space on Amazon flights. He pointed to existing cargo routes to Alaska where the airline ships cargo into the state and then fills the plane with seafood to fly back out of the state.

The Amazon deal “is a new stream of revenue that we never had before,” St. John said.

For its commercial routes, Alaska placed an order for 12 737-10s with expected deliveries in 2028. Boeing is still awaiting certification from the Federal Aviation Administration for the latest 737 MAX variant.

Expanding in Seattle

As Alaska works to transform Seattle into a “global gateway” for travelers, it will need to increase the number of pilots and crew members working on Boeing’s 787 and based in its headquarters city, St. John said Wednesday.

Alaska’s current 737 base has more than 1,500 pilots. The 787 base, once it reaches full capacity in 2030, will have up to 600 Seattle pilots.

Alaska has started a bidding process for its existing pilots and crew members to request a move to Seattle and a hiring process to backfill those roles as people shift locations. Seattle-based pilots and crew will begin training in the fall and flying in March.

The initial 787 base will include about 45 pilots.

Separately, Alaska laid off 252 Hawaii-based nonunion employees who were in interim roles this month, a spokesperson said. Those employees helped integrate Alaska and Hawaiian in the first year of its merger and are separate from the unionized pilots, crew members and flight attendants who work at both carriers.

Because Alaska employees previously flew only Boeing 737 planes, the company is bringing a 787 simulator to its training center in Tukwila to train pilots and crew members on the widebody aircraft.

Alaska will also need to consider new hangar space in the Puget Sound region for maintenance and repair for the 787 fleet it is inheriting from Hawaiian Airlines, but St. John said the company hasn’t made any decisions yet on where that will be.

In the meantime, it will continue using Hawaiian’s Honolulu hangar, as well as Alaska’s Paine Field hangar that it currently uses for regional carrier Horizon Air. It is also building a hangar in Portland, St. John said.

“Hangars take a couple of years to build, so our maintenance team is working on what to do in the interim,” he said. It will rely on a “mix of a lot of things before we figure out the long term solution.”

The outage

Alaska reported its second quarter earnings days after an IT outage grounded its fleet for three hours Sunday night, prompting roughly 200 flight cancellations and days of travel disruptions.

Alaska said Monday the outage was the result of an “unexpected failure” of a crucial piece of hardware at its data centers.

But it’s still unclear what led that system — and its backup system — to fail, St. John said Wednesday, adding that it is “very rare” for both systems to have gone out one after the other.

“It was a little bit of a perfect storm,” he said. “It’s still early. We don’t know what happened to the system and why both of them failed but we’ll get to the bottom of it.”

Alaska’s operations were running smoothly again by Wednesday, St. John said. Alaska did not see any immediate impact to bookings as a result of the disruption.

The company will feel some financial hit from the outage, including reimbursing customers for changed travel plans and paying employees for overtime work, St. John said. That impact will appear in Alaska’s third-quarter financial results, which covers July, August and September.

This story has been updated to reflect that Alaska surpassed its guidance for earnings per share using adjusted numbers.

©2025 The Seattle Times. Visit seattletimes.com. Distributed by Tribune Content Agency, LLC.

Comments