New rivals move in on Claire's turf, contributing to the mall jewelry chain's second bankruptcy

Published in Business News

New competitors across the nation have moved in on Claire’s turf, proving how difficult it is for longtime mall chains to stay popular.

The Illinois-based jewelry chain filed for Chapter 11 bankruptcy protection earlier this month, citing mounting competition, shifting consumer spending, the decline of in-store shopping and heavy debt.

Last week, executives said Ames Watson, a private equity firm that owns Champion Teamwear and Lids, will buy its North American business.

Meanwhile Lovisa’s fast-fashion jewelry shops, Rowan’s nurse-led ear-piercing studios and Gorjana’s coastal-inspired boutiques are gaining ground.

Mall of America in Bloomington, Minnesota, still has three Claire’s locations, but it has also added Rowan, Lovisa, Gorjana and Little Words Project, a beaded bracelet brand with designs reminiscent of friendship bracelets.

Claire’s filed for bankruptcy after deferring interest payments on a $480 million loan. The company listed assets and liabilities between $1 billion and $10 billion.

Ames Watson will acquire as many as 950 stores, though the retailer operates about 1,500 stores in the U.S. and Canada. It’s unclear which are on the chopping block.

The collapse of the jewelry chain once synonymous with mall ear piercings and glittery accessories, highlights the pressure mall-based retailers, particularly those targeting younger shoppers, are under.

But analysts said Claire’s faces deeper problems than debt and the popularity of malls.

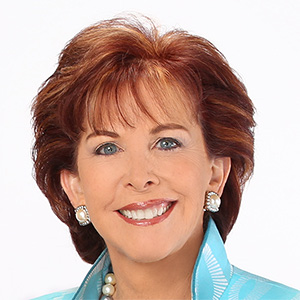

“When you fall into bankruptcy for a second time, it indicates there are some serious underlying problems you’ve not been able to resolve,” said Neil Saunders, managing director of GlobalData Retail. “The process should be about restructuring, putting the business on a firmer track, and that’s what the first round should have done.”

For decades, Claire’s thrived as a rite-of-passage stop for ear piercings and glittery accessories, but rivals are gaining traction.

Rowan plans to add 30 more stores this year. It started as an at-home service in 2018 but switched to brick-and-mortar retail a year later.

The company tested out shop-in-shops in hundreds of Targets in 2020 but exited the retailer in 2022 to focus on its own stores.

The chain has also taken on a piece of Claire’s territory: piercings.

Instead of store associates with piercing guns, Rowan employs licensed nurses who perform piercings with hand-pressurized devices or needles, touting it as safer.

California-based Gorjana, known for its modern necklaces, bracelets and rings, is also expanding, adding to the competition for teen jewelry shoppers.

“Claire’s still has a slightly childish, sort of 1980s vibe,” Saunders said. “The younger customer of today is much more sophisticated.”

Lovisa, a company based in Australia, offers “a much more contemporary take on jewelry, still very inexpensive, but seems to be much more mature,” he said. That wider appeal has helped it grow.

The pressure isn’t just coming from inside the mall. Online competitors have made the squeeze even tighter.

Ultra fast-fashion platforms like Shein and Temu churn out thousands of low-cost products daily, giving shoppers near-instant access to whatever styles are trending on TikTok or Instagram.

Shein now controls about half of the U.S. fast-fashion market, far surpassing older players like H&M and Zara, according to consumer spending data. Its model — low prices, constant newness and an easy mobile shopping experience — has trained younger shoppers to expect endless variety at the tap of a screen.

“Claire’s lacks the brand weight and visibility online,” Saunders said, noting that e-commerce rivals have reshaped expectations for value and convenience.

Tariffs on imported goods have added to costs, but analysts said they are not the main driver of the company’s decline.

“The debt problem existed long before tariffs came along, the proposition problem existed before tariffs came along,” he said. “Other jewelry retailers are managing tariff impacts without filing for bankruptcy.”

©2025 The Minnesota Star Tribune. Visit at startribune.com. Distributed by Tribune Content Agency, LLC.

Comments