Jill On Money: Consumers feel the heat amid Fed meeting

At its recent policy meeting, the Federal Reserve opted to hold short term interest rates steady at 4.25-4.50%, as it weighs how the Trump tariffs will cycle through the economy.

Tariffs have just begun to impact economic growth. First quarter growth (GDP) decreased at an annual rate of 0.3 percent, a substantial slide from the 2.4% expansion in Q4 2024.

The drop was largely due to a surge in pre-tariff imports, which is expected to reverse in Q2. But within the report, there are warnings, according to Diane Swonk, Chief Economist at KPMG. “The rise in spending to hedge against a surge in tariffs masks an underlying weakness, notably in business investment. (E.g., Front-running tariffs artificially boosted spending on information technology.)”

Meanwhile, the inflation rate, as measured by the March Personal Consumption Expenditure Index (PCE) was up a somewhat stronger than expected 2.3% from a year ago.

Core prices, which exclude food and energy, increased 2.6% from a year ago, the lowest level since June 2024, but still above the Fed’s 2% target. Swonk notes that upward revisions in the January and February numbers “suggest that inflation was stickier ahead of tariffs than previously thought.”

The tension between a slowdown in growth and potentially accelerating inflation could put the Fed’s dual mandate (to promote economic/labor market growth and to keep prices in check) in conflict. The central bank will wait and see whether it needs to adjust policy to address one side or the other, which could take months.

It may not take that long for consumers, many of whom are already feeling the heat. When the nation’s biggest banks released their quarterly earnings, they revealed that many credit card holders are not able to keep up with their payments.

The uptick in distress continues a trend that started last year. The Philadelphia Fed found that the percentages of credit card accounts 30, 60, and 90 days past due increased and “the share of credit card accounts making the minimum payment has hit series highs in each of the past two quarters,” indicating “greater consumer stress.”

That stress will not go unnoticed by policymakers, especially with the average credit card rate charged on those who carry a balance at 21.9%. And if prices reaccelerate, the pressure will increase on these borrowers – and everyone else, especially middle to low-income households. As a reminder, inflation is regressive, meaning it hurts lower-income Americans disproportionately.

Consider a household living paycheck to paycheck, earning $60,000 a year. Most of that income is gobbled up by essentials, like food, housing, transportation, utilities — the items that often see the biggest price increases, when inflation rises.

Compare that household with one that earns $400,000. While the wealthier family has to absorb higher costs, they typically spend a smaller portion of their income on necessities. They also have financial cushions, in the form of savings, investments, and a chunk of equity in a home.

For those with limited resources who live on tight budgets, inflation isn't just an economic indicator — it's a daily struggle that forces impossible choices about which necessities to prioritize.

Inflation can also eat away at our short- and long-term confidence. The Conference Board’s Consumer Confidence Index tumbled to its lowest level since May 2020, as respondents are expecting a dark period for the next six months.

The so-called “Expectations Index” tumbled to the lowest level since October 2011, “well below the threshold that usually signals a recession ahead.”

And looking ahead, a whopping 64% of Americans “worry more about running out of money than death,” according to Allianz Life’s 2025 Annual Retirement Study.

========

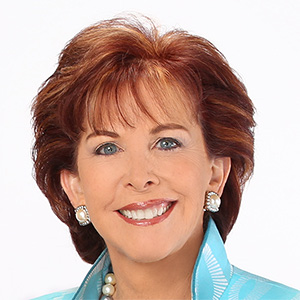

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2025 Tribune Content Agency, LLC

Comments