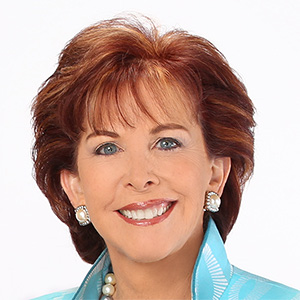

Terry Savage: Know what you own

In the midst of all the advice about not panicking over stock market volatility lies a hidden vulnerability: Most people have very little idea about how exposed they are to the stock market!

In fact, if you ask people to just give an estimate of what percentage of their non-housing assets are invested in the stock market, you often get a blank stare. Try it another way: Can you name the five largest fund or stock holdings inside your 401(k) plan? Or your IRA?

Few people can do that. The investment choices were decided upon years ago, and never reviewed. It seemed enough of a commitment to simply allow the monthly deduction from your paycheck. “It’s all the stock market, isn’t it?”

This is the perfect time to take a closer look at what’s inside your retirement account. The market has rebounded significantly from the initial tariff shock. But it remains volatile amid uncertainty over the economic impact as tariffs take effect. And if consumer spending slows, more stock market downside could remain.

Instead of reacting blindly, you’re more apt to stick with your investment plan if you know exactly what you own, and how vulnerable you are to a potential further market decline.

Start with your latest quarterly or monthly statement from your investment accounts. If the money is in your 401(k) or 403(b) plan, your HR department must have given you information about the investment strategy of each fund. Or go to Mornignstar.com to look up each fund.

At Morningstar, you will immediately see the category into which your fund falls — ranging from aggressive growth to conservative stocks. You’ll see each fund’s performance history compared to other, similar funds. And you’ll get a breakdown of its exposure to various market sectors.

The point is not to turn you into a sophisticated investor. Nor is it to second-guess your investment adviser. But you really should examine your exposure to the stock market. You might have reached an age when more conservative investments make sense.

Recognizing their limited abilities, many people have turned to the target-date fund option within their employer-sponsored plans. In fact, according to Morningstar, there is now more than $4 trillion invested in target-date funds. And they have performed well.

Morningstar says: “As the first large cohort of target-date 2025 investors reaches retirement, a full 15-year savings cycle reveals these investors saw average annualized returns of 7.3%, well exceeding expectations and demonstrating the effectiveness of these strategies in supporting retirement goals.”

Your immediate reaction might be that an average return of 7.3% is nothing to shout about, but remember that these investors were allocated to more conservative portfolios as they reached their targeted retirement date. By limiting downside risk, the asset allocation is designed to bring people to a more secure retirement.

Not everyone thinks that target-date funds are the best answer to asset allocation as you approach retirement. Ron Surz of TargetDateSolutions.com has long advocated a much more conservative allocation for near-retirees than most target-date funds offer. He points to 2022, when a mixed allocation to both stock and bonds caused big losses as both markets reported double-digit declines. (Stocks went down 18% on the S&P 500 Index, and even conservative 10-year Treasury bond prices fell 10.6% as interest rates rose.)

Surz has created a more conservative target-date allocation, with as much as 70% in risk-free assets like Treasury bills as people approach and enter retirement. It will take another dramatic market decline to validate his point about the risk inherent in most target-date funds for retirees and pre-retirees. But the concern should inspire you to make sure you have enough liquid, safe “chicken money” outside your target-date fund.

It’s a simple emotional fact that as retirement looms near, risk tolerance falls. It’s one thing to invest aggressively for the long run when you’re still working and contributing to your retirement plan. But as you get older, and until you face a market decline, you might not be aware that your investments carry risk — and that your tolerance for volatility has disappeared!

That’s the most important reason to know what you own. It’s perfectly fine to own stock funds throughout your retirement — as long as you have multiple sources of income outside your investment portfolio. If your pension and Social Security give you enough regular income to cover your monthly expenses, you’ll want your IRA to generate long-term growth through stock investments.

But if you’re planning to dig into your current retirement account balance every year to support your lifestyle, you want to make sure that account balance will remain predictably level, except for withdrawals. The stock market won’t do that! And that’s The Savage Truth.

========

(Terry Savage is a registered investment adviser and the author of four best-selling books, including “The Savage Truth on Money.” Terry responds to questions on her blog at TerrySavage.com.)

©2025 Terry Savage. Distributed by Tribune Content Agency, LLC.

Comments