Private equity targets 401(k) plans

Wall Street has a new target. With nearly $9 trillion in assets, 401(k) plans have caught the eye of Wall Street insiders. For years, they have been investing in “private equity” and venture capital deals. They find small, promising companies and lend their capital and management expertise — hoping to sell out in the public stock markets for huge gains.

But in recent years, there has been little opportunity for these insiders to cash in and realize profits to be distributed back to their investors. A slowing market for initial public offerings (IPOs) means many are “stuck” in their deals, with little liquidity.

Stock market volatility, higher interest rates, and a preference for large tech companies have muted deal activity, and the chance to redeploy profits (and fees) into new deals. Those who need to sell out of these deals must take a huge discount because there are so few buyers.

Ordinary investors aren’t aware of this dire situation for Wall Street tycoons, since individuals have been largely prohibited from investing in private equity, unless they can demonstrate they have significant risk capital and financial assets outside the value of their home.

That’s all about to change. Now Wall Street is looking to let ordinary investor get in on these deals — by including them as investment options inside their 401k) plans. And they’re getting help from the current administration.

The SEC’s Office of the Investor Advocate has named the inclusion of private equity and other alternatives in retirement plans as a top policy priority for 2026. Is the SEC protecting the small investor here, or the big boy investors who are stuck in their deals?

Major asset managers like BlackRock are preparing to launch target-date funds for 401(k)s with a 5%–20% allocation to private investments, including PE and private credit, starting in 2026.

But such investments come with concerns for plan sponsors, who are supposed to act as fiduciaries. In 2020 the Labor Department, which regulates retirement plans, cautiously opened the door to small amounts of private investments in 401(k) plans, while warning about valuation and liquidity risks.

That is a sophisticated way of saying that no one really knows what these investments are worth — until they try to sell out and get their cash back. As private equity, there is — by definition — no public market to set prices for all to see. Even worse, there may be no buyers, leaving investors stuck.

Huge public pension funds started investing in private equity many years ago, expecting easy and profitable liquidation of these assets in 6-10 years — just when they’d need the cash to pay our promised pensions. Now they’re scrambling to increase liquidity by selling other assets.

Recent data show that the pace of private equity exits has fallen to a two-year low. And PE funds haven’t been making distributions to their pension fund investors, amid this “exit drought."

Inside Wall Street, private equity is being compared to a “roach motel” — easy to get into, and almost impossible to get out!

Now they are opening the doors of that roach motel to YOU via your retirement plan. And you’re supposed to be grateful for this unprecedented opportunity. You may soon find these private equity deals inside a target-date retirement plan, or as stand-alone investment choices offered by prestigious Wall Street firms.

My advice is: Don’t take the bait. Investment firms are required to warn that past returns are no guarantee of future performance. That’s never been more true than today, despite huge wins in the past. Now the world of private equity is searching for liquidity and eyeing the unsuspecting trillions of dollars in company retirement plans.

If you step into this roach motel, they won’t “leave the light on for ya.” And that’s The Savage Truth.

========

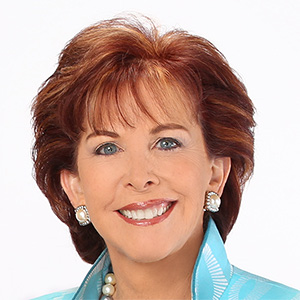

(Terry Savage is a registered investment adviser and the author of four best-selling books, including “The Savage Truth on Money.” Terry responds to questions on her blog at TerrySavage.com.)

©2025 Terry Savage. Distributed by Tribune Content Agency, LLC.

Comments