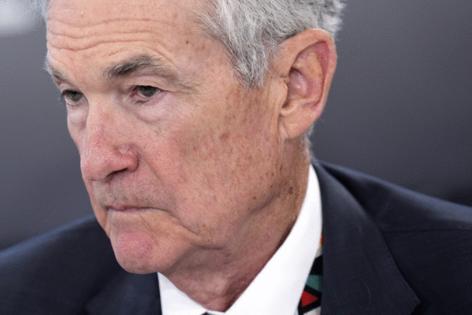

Trump pressures Fed's Powell to cut rates 'a full point'

Published in News & Features

President Donald Trump urged the Federal Reserve to cut interest rates by a full percentage point, intensifying his pressure campaign against Chair Jerome Powell.

“ ‘Too Late’ at the Fed is a disaster!” Trump posted Friday on social media, using a derisive nickname for Powell. “Despite him, our Country is doing great. Go for a full point, Rocket Fuel!”

While the size of Trump’s rate-cut demand — a full percentage point — was unusual, his call for the central bank to lower rates is not new.

The president, who first nominated Powell to the job in 2017, has regularly complained that the Fed chief has been too reluctant to cut borrowing costs. Trump pushed Powell to lower rates in a White House meeting last month.

Trump said later Friday he was considered successors for Powell, whose term as chair ends in May 2026. “It’s coming out very soon,” he told reporters on Air Force One, without naming any potential candidates.

“I have a pretty good idea who,” Trump added.

After Trump was specifically asked about Kevin Warsh, a former Fed governor considered among the potential successors to Powell, he responded: “He’s very highly thought of.”

Fed officials are scheduled to meet June 17-18 in Washington and are widely expected to leave their benchmark rate unchanged, as they have done all year. Many policymakers have said they want to wait for more clarity over how Trump’s policies on trade, immigration and taxation will affect the economy before they alter rates.

It would be highly unusual for the Fed to lower its benchmark rate by a full percentage point at one meeting outside of a severe economic downturn or financial crisis. Officials last cut rates by a full point in March 2020, when the U.S. economy was cratering as the Covid-19 pandemic prompted widespread shutdowns and layoffs, triggering a deep recession.

The Fed targets 2% inflation over time, and adjusts interest rates with the goal of maintaining both stable prices and maximum employment — the two responsibilities assigned to it by Congress. Lowering rates too quickly could stoke inflationary pressures, while holding them at high levels for too long could restrain the economy more than desired.

Trump posted his call on social media after new data showed U.S. job growth moderated in May, but was still better than expected, and the unemployment rate held at a low 4.2%. In a separate statement, the White House touted the “BOOMING economy,” including job gains, increasing wages and tame inflation.

Fed policymakers in recent weeks have described the labor market as on stable footing, which they’ve said provides further cause for them to keep borrowing costs steady for now — especially with inflation still above their target.

Borrowing costs

Trump, in a subsequent message, accused Powell of “costing our Country a fortune” by keeping rates at their current level, saying they have increased borrowing costs for the federal government that “should be MUCH LOWER!!!”

“If ‘Too Late’ at the Fed would CUT, we would greatly reduce interest rates, long and short, on debt that is coming due. Biden went mostly short term. There is virtually no inflation (anymore), but if it should come back, RAISE ‘RATE’ TO COUNTER. Very Simple!!!” he posted.

U.S. borrowing costs have swelled in recent years as the Fed lifted interest rates to combat historically high inflation. The average interest rate on U.S. Treasuries outstanding is currently around 3.36%, well above levels the government enjoyed before the Fed started ramping up rates.

Last fiscal year, the government’s interest costs on debt were the equivalent of 3.06% as a share of gross domestic product, the highest ratio since 1996.

Trump and congressional Republicans have vowed to rein in government spending and lower deficits, but the tax bill they are advancing would likely do the opposite, according to several estimates.

The nonpartisan Congressional Budget Office said Thursday that added interest costs from the bill would come to $551 billion over a decade. CBO estimates didn’t account for other potential effects, such as any boost to growth. The agency separately has estimated interest costs would shrink if high tariffs stay in place, reducing borrowing needs.

(With assistance from Christopher Anstey, Hadriana Lowenkron and Akayla Gardner.)

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments