Trump names Miran to fill seat on Federal Reserve Board

Published in News & Features

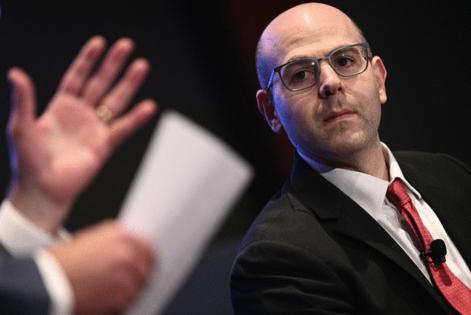

WASHINGTON — President Donald Trump said he had chosen Council of Economic Advisers Chairman Stephen Miran to serve as a Federal Reserve governor.

“He has been with me from the beginning of my Second Term, and his expertise in the World of Economics is unparalleled — He will do an outstanding job,” Trump said Thursday in a social media post.

The president said that Miran, who will need to be confirmed by the US Senate, would only serve the expiring term of Fed Governor Adriana Kugler, which ends in January. “In the meantime, we will continue to search for a permanent replacement,” Trump said.

The Bloomberg Dollar Spot Index erased its daily gains on the news of Miran’s nomination. The Federal Reserve declined to comment.

Miran, who holds a Ph.D. in economics from Harvard University, has echoed Trump’s call for lower interest rates. Miran has established a reputation for delivering his views in a more measured tone than many other Trump advisers. Nonetheless he has been a sharp Fed critic and proposed changes to the central bank that some would view as unorthodox.

In a March 2024 paper, Miran and Dan Katz, now chief of staff at the Treasury Department, laid out a 24-page plan for reforming the Fed that blames policy errors at the central bank on “groupthink.” It also takes the Fed to task for having expanded into political areas that they argue are beyond its remit.

“The Federal Reserve’s record in recent years raises questions about whether it has been operating in line with the best practices of central bank independence,” Miran and Katz wrote.

They called for the separation of monetary policy from banking regulation and supervision at the Fed by stripping the board of its authority over the latter. The change — which would require legislative action — would “avoid unnecessarily polluting the monetary-policy process,” they wrote.

Joe Gilbert, a portfolio manager at Integrity Asset Management, said Miran was “not an expected pick, but it is within the framework that the market was looking for.”

“Miran would provide another voice to conceivably support easier Fed policy,” Gilbert said. This reinforces the belief that the Fed will be easing interest rates for the balance of the year as it is unlikely for the Fed to hold rates steady with three dissents on the board. We have officially entered an easing cycle for markets.”

Other commentators were more skeptical that Miran would have much impact.

“Overall, he’s just one member and he’s not going to go in and bring structural change or lead to larger rate cuts,” said David Beckworth, senior research fellow at the Mercatus Center at George Mason University. “And I really don’t think he can do much in just a few months.”

The Fed has so far this year held off from lowering interest rates despite a gradually cooling U.S. economy. The decisions were taken partly out of concern that Trump’s aggressive tariffs might reignite inflation. Recent data has shown the impact of tariffs in some areas, but inflation has remained largely muted.

Speaking on Bloomberg Television earlier Thursday, Miran said that there was “zero macroeconomically significant evidence of price pressures” from Trump’s increased use of tariffs on US trading partners.

“Overall, we don’t expect significant inflation from the tariffs,” he said. If inflation were to materialize from tariffs, “it would be a one-time price-level shift, not an enduring trend,” he said.

That view puts Miran somewhat at odds with Powell.

“It is also possible that the inflationary effects could instead be more persistent, and that is a risk to be assessed and managed,” Powell said at a July 30 press conference. Those comments followed policymakers’ decision to hold the Fed’s benchmark interest rate steady for a fifth consecutive time.

Miran on Thursday praised Fed Governor Christopher Waller when asked about Trump’s search for a replacement when Powell’s term as chair expires next May.

Waller dissented against the Fed’s decision to leave rates unchanged last month, saying he preferred a quarter-point reduction. Waller has said he expects any inflationary impact from tariffs to result in a one-time increase in the level of prices, while raising concerns about growing signs of weakness in the labor market.

The Senate is on its annual August recess and isn’t scheduled to return to Washington until early September. While Miran has recently navigated the confirmation process to secure his current position, which could speed his approval, his confirmation could still take weeks even if the nomination is prioritized by Republican leaders. Miran was confirmed for his current post in March on a party-line, 53-46 vote.

Senate Banking Committee Chairman Tim Scott called Miran “an accomplished economist” and an “instrumental” adviser to Trump.

“I look forward to quickly considering his nomination,” Scott said Thursday in a statement.

Senator Elizabeth Warren, the panel’s top Democrat, called Miran “a Trump loyalist and one of the chief architects of” his “chaotic tariff policy.”

“I will have tough questions for him during his confirmation hearing about whether he’d serve the American people as an independent voice at the Fed or merely serve Donald Trump,” Warren said in a statement.

Fed officials hold their next policy gathering Sept. 16-17.

_____

(With assistance from George Lei, Natalia Kniazhevich, Steven T. Dennis, Derek Wallbank and Justin Sink.)

_____

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments