This Is No Way to Gimme Shelter

Americans today are justifiably angry about the price of rents and mortgages. Home prices have roughly tripled over the last 25 years, and the median home price is now $415,000.

The 30- and 40-somethings are having a tough time buying a first home. Young families may need to pay a whopping $75,000 on a down payment.

Democrats and some populist Republicans have convinced the Trump administration to pin the blame on institutional investors, including large banks, private equity firms and hedge funds. The Trump administration is endorsing a proposal to prohibit these firms from buying homes and apartments.

This is a classic boogeyman solution that will make the housing shortage worse. The investment funds are an easy target, but they have never gobbled up more than a tiny percentage of the housing market. On average, less than 2.5% of homes are purchased by banks and speculative investors. How can that tiny market share be blamed for a near doubling in home prices?

The houses don't disappear when investors buy them. Investors often renovate and upgrade the fixer-upper houses, then place them on the market for a higher price. Why should this be illegal?

Banning these acquisitions ignores the main reason home prices are rising so rapidly. The supply of new homes is constrained by "not in my backyard" zoning laws and affordable housing bans. These laws artificially reduce the supply of new homes and hand a windfall benefit to incumbent homeowners by artificially inflating their property values.

These rules violate private property rights of landowners and shrink the supply of homes. This benefits baby boomers at the cost of their children. Those laws should be invalidated.

The government-inflated value of homes was made worse by the Biden administration, which gave us 40-year-high inflation and the fastest jump in interest rates in just as long. Biden's regulatory agenda just added insult to injury because it drove up the cost of building homes even further. Trump's tariffs on lumber, steel and aluminum are driving up new home prices too.

We were building plenty of housing from 1980 to 2000, but the pace of construction slowed dramatically after the turn of the millennium because government regulation strangled supply growth. If the prior pace of housing construction had continued for another 20 years, we'd have 15 million more housing units today, and prices would be much lower.

One smart way for Congress to increase the supply of housing immediately would be to index for inflation the capital gains tax on the sale of residential real estate. This would free up millions of homes for sale.

Under current law, if someone bought a house for $500,000 25 years ago and the house is now worth $1.5 million, they get a $500,000 exemption but pay a 23.8% tax on $500,000. But almost all their "gain" was due to inflation. This causes a lock-in effect where older baby boomers who want to downsize can't afford to sell the house because the taxes are too high. So they avoid the tax by dying in the home.

Everyone loses.

As for the boogeyman of investors, take a look at the housing situation in major metropolitan areas. Tampa, Florida, and Austin, Texas, have seen investment and construction booms over the last several years due in part to investors being allowed to pour in capital to revitalize the housing stock. This dramatically increased the number of homes available.

What was the result? Collapsing rent prices and more affordable housing. In Austin, median rents have plunged from their peak under former President Joe Biden, falling more than 20% while incomes rose. Deregulation and an influx of investment added tens of thousands of housing units to the city, and rents are now about the same percentage of renters' income as in 2019.

If Congress and the White House believe in the power of free markets, they should see real estate investors as part of the solution to the housing shortage, not as villains.

========

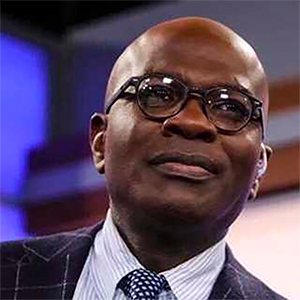

Stephen Moore is a former Trump senior economic adviser and the cofounder of Unleash Prosperity, which advocates for education freedom for all children.

Copyright 2026 Creators Syndicate Inc.

Comments