Abby McCloskey: Trump Accounts? Republicans have had better ideas

Published in Op Eds

The Republican tax bill contains flashy goodies for families with kids. The flashiest: savings accounts for children — branded Trump Accounts — created and initially funded by the Treasury Department. These will consist of $1,000 in invested assets for each American citizen born through 2028, plus whatever funds parents later add.

So if you want to have a baby, hurry up! The seeding of the accounts (previously called MAGA Accounts) expires at the end of President Donald Trump’s term. The president has made his goal clear: “I want a baby boom.” House Republicans also proposed expanding the Child Tax Credit from $2,000 to $2,500; that would also expire in four years.

But if more babies are the goal, these cash carrots are the wrong incentive. Claudia Goldin said it best in her recent paper, “Babies and the Macroeconomy”: “The birth rate is … clearly determined by forces that are independent of the whims of governments.”

In a 2021 review of the literature of thirty-five studies across Europe and North America, “Can Policies Stall the Fertility Fall?,” the three authors — a statistician, a sociologist and a public health expert, all in Norway — concluded that even sizable cash benefits have a modest impact on fertility.

Instead, the authors found child care and paid leave to be more promising levers. Access to child care slightly increased both the number of children families have and the number of first-time births — especially among low- to middle-class families. Child care support may increase the fertility of stay-at-home mothers by giving their older toddlers access to care.

Paid parental leave was also found to have small, but positive, effects on fertility, in particular for higher-earning parents.

Unfortunately, paid leave for parents and child-care support are largely missing from the reconciliation bill, though there are a handful of renewed and expanded tax credits for businesses that provide these things. The GAO reports that these have historically been underutilized.

Perhaps baby-making isn’t the goal anymore. After all, Trump Accounts cannot be accessed until the kids turn 18 and are explicitly for the kids, not the parents making the babies.

Perhaps a better way to view Trump Accounts is not as encouraging a baby boom, but as a broader investment in family economic well-being.

That would be good news. As a country, we chronically underinvest in the young in favor of the old. Parents are more pessimistic about their kids’ future, according to Wall Street Journal polling, than any time in recent memory. The US is an international outlier with its high share of single parents. Labor policy still doesn’t reflect the reality that in most households, all parents are working.

But there are better ways to promote familial financial well-being than Trump Accounts. The same criticisms apply as when Democratic Senator Cory Booker ran for president on a platform of baby bonds: First, families need support today, not locked up funds to be used two decades from now. This is particularly true for the bottom half of the income distribution.

Second, none of these savings accounts speak to each other — 529, 401k, IRA, FSA or HSA, now Trump Accounts. It can be hard to predict where you’ll need the savings, and savers are penalized for withdrawing for other uses. Hence the long-time conservative push for universal savings accounts.

Third, there is still a taxpayer cost attached: a nearly $20 billion price tag when combining the costs of seeding the accounts and tax-free contributions, according to the Joint Committee on Taxation. If the contribution program doesn’t expire after 3.5 years, the price tag will rise by another $15 billion over the next 10 years, based on their average expected annual expenditures for 2027 and 2028. I believe we need more public investment in children, but the question remains: Who is paying for that?

And fourth, two-thirds of American kids cannot read or do math at grade-level by fourth grade. This suggests that instead of an investment whose biggest expected use is higher education, children need earlier investments in high-quality tutoring to stay on track. Before sharing in the noble goal of stock ownership, let's get reading and math right.

To which I’d add a fifth: a four-year expiration date suggests a short-term political mindset and budget trickery much more than seeding the ground for long-run family flourishing.

When it comes to supporting families, President Trump would do best to return to his roots. In his first term, he doubled the Child Tax Credit; boosted funding for the Child Care and Development Block Grant, the country’s primary way of delivering child-care support to low-income families; passed 12 weeks of paid parental leave for all federal workers; and proposed a universal 6-week paid leave program for all American moms.

On top of this, he oversaw a time of exceptional economic growth. This go-around he seems determined to inflict tariff pain and higher costs on American families. An extra $500 in child tax credit payments per family for a few years sounds nice, until you realize that the costs of tariffs per family are currently estimated to be nearly $3,000, per the Yale Budget Lab. Moreover, the bill as drafted puts us somewhere between $3 and $4 trillion more into debt; guess who inherits that.

It might not have had the snazzy Trump Account branding, but Trump’s first term arguably was a much better deal for babies.

____

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

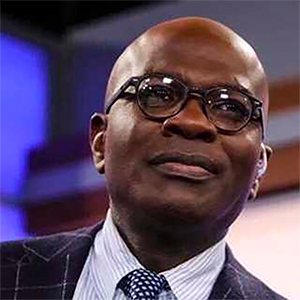

Abby McCloskey is a columnist, podcast host, and consultant. She directed domestic policy on two presidential campaigns and was director of economic policy at the American Enterprise Institute.

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments