COUNTERPOINT: Salty over SALT

Published in Op Eds

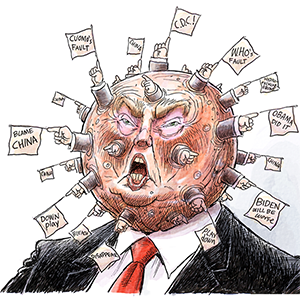

Imagine President Donald Trump waking up to the news that California faces a $12 billion deficit, and instead of letting the state reckon with its budget bloat, announcing a plan to make taxpayers in West Virginia, Ohio and the Dakotas help bail out the likes of Gov. Gavin Newsom. Unfortunately, a small band of Republicans in the House has been fighting to make this scenario a reality.

The Big Beautiful Bill, passed by the House last week, accomplishes a number of important policy goals. Most importantly, it forestalls the expiration of the Tax Cuts and Jobs Act (TCJA), sparing taxpayers from significant tax increases. According to the Tax Foundation, if the TCJA were to expire, 62 percent of households would see higher taxes.

Some households will experience a larger hit than others. A single filer earning $75,000 could face an increase of more than $1,700, while a family of four making $165,000 might pay an extra $2,450. For families with three children earning $200,000, the increase could soar to nearly $7,500. Preventing this tax hike on families is rightfully a priority for Trump and the GOP-led Congress.

Beyond reducing household tax liabilities, the TCJA also simplified taxes for millions of Americans. By nearly doubling the standard deduction, it substantially reduced the number of people who had to itemize deductions. Before the TCJA, 30% of individual tax returns included itemized deductions. By 2018, the number had dropped to 11%, and it has remained around 10% since then. This tax simplification was a win for many Americans, particularly those who had long been burdened by the detailed and time-consuming record-keeping required by itemization.

Before the enactment of the TCJA, taxpayers could deduct all state and local taxes (SALT) from their federal income tax. Another tax provision, the Alternative Minimum Tax, however, effectively capped this deduction. The TCJA essentially repealed the AMT but imposed a $10,000 cap on the SALT deduction. This interaction is complicated, but the upshot is that combined with other policy changes in the TCJA, most taxpayers — even those in high-tax states — saw a tax cut.

The tax bill, as passed by the House, unfortunately backpedals on this policy and increases the SALT cap to as much as $40,000 before phasing down to $10,000 for taxpayers exceeding certain income thresholds. In general, it would effectively provide no tax relief to an overwhelming majority of taxpayers and amount to a $300 billion subsidy to high-income taxpayers in high-tax states such as California, New York and New Jersey.

The last time Congress contemplated a similar policy change was during the consideration of what became the disastrous Inflation Reduction Act. The House-passed version contained a significant increase in the SALT. As the current administration and congressional majority look to turn the page on the policies of the recent past, it’s hard to see why Congress would look to Nancy Pelosi’s last Congress as Speaker of the House for policy inspiration.

It follows that progressives would support higher SALT deductions. Allowing taxpayers to deduct state and local taxes from their federal liability reduces the effective cost of a state and local tax increase. For high-income taxpayers in expensive locales, this is a good deal.

Insofar as states generally must balance their budgets, this policy amounts to a taxpayer subsidy of state and local services. For most out-of-state taxpayers, it’s a lousy deal. The research is clear that ending this subsidy won’t reduce services but focus the tax burden more appropriately on the taxpayers who consume those services.

If Californians want California’s level of taxes and spending, they can have it, but taxpayers in Ohio shouldn’t have to subsidize it. As the One Big Beautiful Bill heads to the Senate, policymakers have an opportunity to fix this mistake — and they should take it.

_____

ABOUT THE WRITER

Gordon Gray is the executive director of Pinpoint Policy Institute. He wrote this for InsideSources.com.

_____

©2025 Tribune Content Agency, LLC

Comments