Commentary: Cutting housing counseling is a grave mistake

Published in Op Eds

For generations, owning a home has been one of the most effective ways for American families to build wealth, stability and long-term opportunity. But for far too many families, especially those who are Black and Latine, this opportunity remains out of reach.

Sustainable homeownership means giving people the tools and support they need to make informed decisions for long-term success. That’s what housing counseling does. Usually working at nonprofit organizations, trained counselors certified by the U.S. Department of Housing and Urban Development (HUD) help individuals and families navigate every stage of the housing journey, from renting to buying to holding on to their homes during hard times.

The advice of these counselors is unbiased, typically free and grounded in the best interests of families and communities. They help clients build budgets, improve credit, understand down-payment assistance programs and avoid scams. When crises like illness or job loss strike, housing counselors are often the ones helping families avoid foreclosure.

This work has significant reach. HUD data shows that from October 2023 to September 2024, more than 4,600 HUD-certified counselors assisted more than 850,000 households. In Illinois alone, 193 HUD-certified counselors assisted more than 34,000 households. More than 2,000 families purchased their first home, and approximately 800 families avoided mortgage default or foreclosure, stabilizing not only these families but entire neighborhoods.

But the budget proposed by the House of Representatives eliminates funding for HUD’s Housing Counseling Program from the nation’s budget for fiscal year 2026. This is not just a routine cut. It’s a reversal of decades of bipartisan support for sustainable homeownership and housing stability. The Senate could restore housing counseling funding in its budget proposal, which would then need to be negotiated with the House of Representatives.

At Housing Action Illinois, a HUD-approved intermediary, my work involves supporting a network of 35 housing counseling agencies across the Midwest and beyond. I see up-close how the numbers translate into real, life-changing stories.

An agency in our network recently helped Yara, a single mother in Central Illinois who was overwhelmed by the homebuying process. It connected her with Tessa, a housing counselor who helped her walk through the process of building credit and preparing for home ownership. With Tessa’s guidance, Yara secured down payment assistance and became a first-time homeowner.

Then there’s China, who came to a Missouri-based counselor with a low credit score. Over two years, she followed a personalized plan to pay off student loans and raise her credit, eventually qualifying for a mortgage. After closing on her new home this past winter, she returned for post-purchase counseling to stay on track.

I also think of Elliot, a single father of four who spent five years working with a housing counselor in Wisconsin. With support and perseverance, he went on a remarkable journey from homelessness to homeownership by rebuilding his credit, growing his savings and qualifying for a Habitat for Humanity home.

As housing becomes harder to find amid growing economic uncertainty, housing counseling becomes even more of a lifeline. That’s why it’s alarming that these budget proposals zero out funding for HUD’s Housing Counseling Program. Eliminating this support turns away from decades of federal policy that has embraced homeownership as a core national goal.

For nearly 60 years, housing counselors have helped families buy and keep homes — in big cities, small towns and rural communities alike. This work has been especially important during tough times, such as the foreclosure crisis and again during the COVID-19 pandemic, when housing counselors were on the front lines, meeting with clients and contacting banks and servicers to help homeowners to keep their homes.

We need housing counseling just as much now. High interest rates, low inventory and rising costs have created steep barriers for first-time buyers, especially those without family wealth or insider knowledge of the market.

If the administration truly believes in making homeownership more accessible, it must back that belief with action. That means fully funding HUD’s Housing Counseling Program, not abandoning it. Sustainable homeownership doesn’t just change one family’s future. It stabilizes neighborhoods, grows local economies and builds intergenerational opportunity. What we need is the political will and investment to keep housing counseling robust.

____

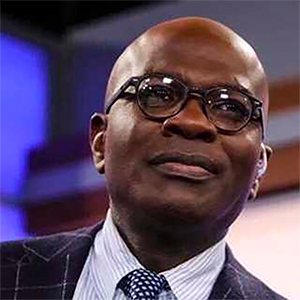

David Young is director of capacity building at Housing Action Illinois. This column was produced for Progressive Perspectives, a project of The Progressive magazine, and distributed by Tribune News Service.

_____

©2025 Tribune Content Agency, LLC.

Comments