Auto supplier Bosch has big North American growth plans

Published in Business News

North America had the largest sales increase globally for Robert Bosch GmbH in 2024, growing 5% year-over-year, the German auto supplier said Wednesday.

The privately owned manufacturer posted in North America consolidated sales of $17.3 billion (16 billion euros) and net sales of $18.6 billion, which included sales of non-consolidated companies and internal deliveries to affiliated companies. The growth moves toward Bosch's goal of having the region represent 20% of global sales by 2030 — just as President Donald Trump has increased tariffs on imported vehicles and certain auto parts.

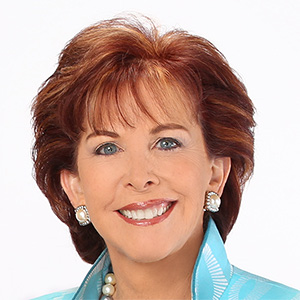

"We're not holding off investment," Paul Thomas, president of Bosch in North America and of Bosch Mobility America, said during a virtual briefing. "We're looking for some stability."

That growth comes as Bosch and its competitors face 25% U.S. tariffs on more than 100 categories of imported auto parts, from engines and steering wheels to hinges and more. Thomas said Bosch tries to meet U.S.-Mexico-Canada trade agreement requirements to avoid the tariff on its products and is working with customers to find the place that makes the most sense for manufacturing of its parts.

“Global trade under fair competitive conditions is very important to us and for us here in the region," Thomas said. "As we invest to grow, we recognize the need for favorable trade opportunities and, more importantly, a stable trade environment to help achieve our goals. Across our portfolio, we prioritize local manufacturing to support local customers. So focus on strengthening domestic manufacturing is a good thing."

Bosch, which marks 120 years in the United States next year, highlighted $2 billion in capital expenditures over the past five years in the United States, more than 75% of its investments in the region. Since 2023, it's also announced plans to invest roughly $6 billion in U.S.-based acquisitions.

"It's good to see that this has created a little bit of a discussion to bring manufacturing here into the U.S.," Thomas said, "but it's something that we've been talking about already for the last multiple years."

Meanwhile, Bosch has been laying off thousands of workers in Europe, especially in its native Germany, to counter slumping demand as underperforming electric vehicle sales, increased competition particularly from China, and economic pressures rattle the auto sector there.

Bosch has more than 15 U.S. manufacturing sites employing about 20,000 people. It's also expected to close this year its $8.1 billion acquisition of Johnson Controls International plc's residential and light commercial heating, ventilation and air-conditioning business that includes brands like Coleman and York. Bosch plans to launch production of second-generation silicon carbide microchips next year at a Roseville, California, facility it acquired in 2023.

The supplier also has a new venture capital fund called Bosch Ventures, which will have $270 million to support innovation in electromobility, hydrogen, software-defined vehicles, factory automation and other areas.

In 2024 in North America, Bosch's mobility business increased sales to third parties to $10.7 billion, consumer goods increased to $3.4 billion, energy and building technology rose to $1.9 billion, and the industrial technology sector fell to $1.3 billion.

Globally, Bosch sales revenues fell 1.4% to $101.4 billion (90.3 billion euro) last year, though after adjusting for exchange rates, the decline was 0.5% less. Operating earnings margin was 3.5%, and the group is targeting 7% for 2026. Bosch is aiming for between 6% and 8% annual growth until 2030. In the first quarter of 2025, sales revenue rose by 4%, but it's going to be a challenging year, especially given the tariff situation, the company said.

Bosch also says it continues its commitment to multiple kinds of powertrains, including gas- and diesel-powered, hybrid, all-electric and hydrogen fuel cell, as the road to increasing electric vehicle adoption has been bumpier than expected because of affordability issues, range anxiety, limited access to charging stations, and other factors. It also continues development of advanced driver-assistance systems and sensors.

"We want to provide manufacturers, and ultimately the U.S. consumer," Thomas said, "with affordable options in the market, while continuing our enduring goal of increasing efficiency and reducing emissions."

©2025 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments