Law or medical school may be out of reach for more college students after new federal loan limits

Published in News & Features

Charlie Rollin, a rising St. Olaf College junior, has begun to retool his plans to attend veterinary school.

That’s because, within the many provisions of the massive, Trump-backed tax package, known as the “One Big Beautiful Bill,” are new restrictions on borrowing for graduate and professional school students.

Some schools are now financially out of reach for Rollin, who is relying on loans and scholarships to finance his education.

“Madison (Wis.) is no longer an option,” he said. “And that sucks, because what if they had said yes? I mean, I literally cannot go.”

The bill will make two major changes to student loan borrowing: It sets new caps on direct federal loans and eliminates the Graduate PLUS loan program, which allowed students to borrow their full cost of attendance without requiring them to demonstrate financial need.

“The bottom line, in our view, is higher education overall just got significantly more expensive,” said Justin Monk, director of student and institutional aid policy at the National Association of Independent Colleges and Universities (NAICU).

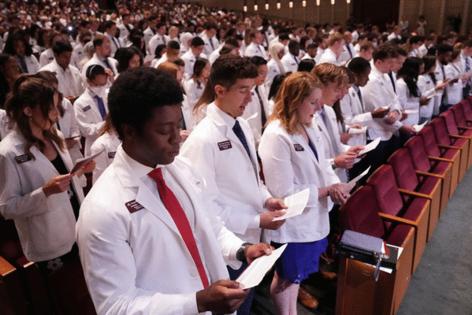

The changes mean many students in expensive but high-earning professional programs like law or medicine may not be able to pursue them without family wealth or access to private loans, since total costs often climb above the new loan limits.

Graduate and other professional students may also be priced out — or may never consider an advanced degree at all. Lower-income students, those from rural areas, students of color and first-generation students will be most affected.

“The changes directly impact access and will shrink the pipeline of jobs and careers that serve the public,” said Nick Anderson, financial aid director at Mitchell Hamline School of Law in St. Paul. “That will have a ripple effect.”

The changes will begin next summer, but only for students entering a new program — those who started school this fall or earlier will be “grandfathered in” to the old loan structure.

Proponents of the changes have pointed to research that suggests that these loans encourage schools to raise prices without improving education or job outcomes for students. But other experts said the idea that federal loan access increases higher education’s price tag has been proven false.

All the loan changes in the bill, including Parent PLUS loan caps, will save the government $44 billion over a decade, according to the Congressional Budget Office.

Some Minnesota students eyeing professional and graduate degrees said restricting the amount they can borrow from the government will put pressure on them to compete for scholarships, narrow their pool of schools to apply to or force them to take out private loans.

Graduate students will now face a lifetime borrowing limit of $20,500 each year for federal unsubsidized loans and a lifetime cap of $100,000.

For professional students, including law school and medical school students, the caps for borrowing are now $200,000 over a lifetime and $50,000 annually.

The package will also eliminate Grad PLUS loans, which many students rely on to cover expenses beyond limits on direct borrowing. They come with a higher interest rate but can also be used to cover room and board, transportation or even day care.

Students could take out private loans instead, officials said, but not everyone will qualify since they’re based on credit scores. Private loans have higher interest rates and may require a co-signer. They also offer less flexible payment plans and lack protections. A private lender could also decide a certain degree program isn’t worth the financial risk.

“It’s going to be a windfall” for private loan providers, Monk said.

Most students at Mitchell Hamline are working adults, Anderson said, and 75% of students take out loans to cover tuition and fees, which total $56,300 for full-time students. Living expenses and books for two semesters are estimated at $23,352. The $50,000 annual loan cap will affect some of the 50% of students who take summer classes to finish faster, he said.

Some data suggests that professional students, like those in law and medicine, were the most likely to borrow more than the new federal caps.

The American Enterprise Institute, a conservative think tank, found that most graduate borrowers from 2019 to 2020 already borrowed less than the $200,000 limit. But around a third of professional students borrowed more than that, and for students at private nonprofit schools, that figure was nearly half.

Sydney Grefsheim, 21, is working full time and applying to medical school. She knows she’ll need to borrow for school, and now, options will be limited.

“I’m just hoping that things will change eventually,” she said. “I’ve always known that I wanted to be a doctor.”

Isam Hussaini, a rising senior at Macalester College, also plans to apply to medical school no matter what.

“I don’t think I would want to let this bill necessarily stop me from doing what I want to do in terms of pursuing the dreams and the career that I would love to have in my life,” he said.

Still, many students said the changes would shift their approach, forcing them to take time off before attending school.

Norah Langager, a rising senior at St. Olaf College, was always planning to take a gap year before law school. But now, she’s considering adding another.

Others, like Rollin and St. Olaf pre-law student Ryan Brentner, are targeting schools that offer in-state tuition or scholarships.

Hussaini said he would look into military programs that pay medical school tuition, while Langager said she was considering putting off her plans to work in the public sector to work at a firm with better pay.

“I have to think about my career afterwards, and how much I can really realistically borrow and then pay back someday,” she said.

Many also said they would consider private student loans, but worried about high interest rates.

Because loans “cover” students’ tuition, institutions can enroll more students and still receive timely tuition payments from either the government or a private lender.

Institutions with a significant population of undergraduates, such as the U, could be insulated from big hits to their bottom line. But other institutions that serve graduate and professional students may face more impacts.

Some smaller, private colleges and universities may close because they will lose enrollment in graduate programs, Monk said. And some programs could end or only be available to students paying full price. Institutions in rural areas that depend on tuition revenue will likely be most affected.

Schools will have an incentive to attract wealthier students to survive, he said. Graduate programs enrolling many low-income students may not be offered anymore because students can’t afford them, he added.

As a result, at Mitchell Hamline, Anderson said there will be fewer public defenders, civil rights advocates and diverse voices, including lawyers and judges, in courtrooms.

A University of Minnesota spokesperson said over 2,500 students took out Grad PLUS loans in 2025, and officials are trying to determine the impacts of recent federal changes.

“The elimination of these loans impacts Minnesota’s future workforce, in professions that are sorely needed,” the spokesperson said.

Richard Painter, a law professor at the U, said “in the near term, this will shut some people out” of law school altogether, unless schools begin increasing need-based financial aid, decreasing tuition or adding more programs that forgive loans.

Most U.S. law schools don’t award financial aid based on need, he said, instead give funding to students with the highest test scores to help increase their national rankings, he said.

There may be a silver lining: Some students who once considered costly law programs at private schools, he said, will now choose the U, where the total cost of attendance is an estimated $83,000 to $93,000.

“This may fundamentally change the economics of law schools,” he said.

_____

©2025 The Minnesota Star Tribune. Visit startribune.com. Distributed by Tribune Content Agency, LLC

Comments